You Need A Budget

Online finance gurus have somehow managed to make conversations about money kind of corny. It's sort of annoying to see Warren Buffet quotes from pages or people that hold money as the end-all-be-all. Financial freedom sounds cool, but selling the idea to everyone and telling people "how to get rich now" is annoying. Realistically, 99.99999% of us will never be billionaires. Most of us will never even be millionaires. In 2020, the median household income in California was $78,672 (Credit Karma). I was gonna throw in more stats here, but my point was going to be that you're more likely to go homeless than you are to become a wealthy billionaire.

Real estate, stock market, large business owning and all that stuff is cool, and you can find financial success in those endeavors to this day, but when you get your head out your ass and have a more pragmatic approach at American livelihood, most of us will tend to live a middle or working class life (and you can still find happiness in that lifestyle, in my opinion). So what can you do about it? Conversations about money are still necessary, but I'm not referring to those pyramid scheme, door-to-door sales talks. We should be talking about saving, we should be talking about investing, we should be talking about how we distribute and allocate our money, and we should be sharing the knowledge with those around us when appropriate. We should all try to improve our financial literacy and learn to make those informed decisions with our dollars.

I've always sucked with money. I would say I have a basic understanding of finance, but I'm learning and educating myself more as I get older. I learned how to be fairly financially responsible like 2 years ago and even now sometimes I get tempted to make unwise purchases. I used to spend every paycheck before my next payday and always ended up with about $20 that I needed to make last until I got paid again. Paydays were great, but the days before I got paid were stressful, especially when my account hit negative because of an autopay transaction I forgot about. The worst part was that I didn't have many bills to pay back then so I was spending money on whatever I wanted. If I had $200 in my bank account, I saw that as $200 I could spend on anything for fun. Rather than finding ways to invest or save a little, I took advantage of my freedom and did whatever I wanted. It was fun and all, but it wasn't sustainable because I knew eventually my parents weren't going to be the ones who would pay my bills. I'm not saying I should have not had fun when I could, but I definitely should have been more conscious about my spending. I did this for so long until I moved out and realized I had to get my shit together because I had a budgeting problem.

Finance is one of those things you don't formally learn early on so it's hard to even know where to begin. Everybody has a different approach and a different outlook on money. My parents didn't really teach me, I didn't learn about it in school, and everyone seems to be very private about it because it's socially looked down upon if you talk about money or bring it up. So I did what most of us probably do and did research online. I watched YouTube videos, read many Reddit posts, and read a lot of articles from finance websites like NerdWallet and Credit Karma which really helped.

Once I realized that maybe I should learn to manage my money better, I tried a bunch of money practices that I just couldn't stick to. I tried Mint, I tried using Excel spreadsheets, I did the 50/30/20 Rule, and I even tried to manage my money in cash because my logic was that I could literally see my money. All these options seemed to work for a lot of people when I did my online research, but none were my style of budgeting at that point of my life. It wasn't until I found the app/website that did it for me and I still use to this day.

For people like myself who need to learn how to handle each paycheck they earn, there is an app I use that has helped me organize my life. You Need A Budget (YNAB) is a budgeting software app that let's you have full control of your money and how you manage it. You assign and allocate money in anyway you choose. I like that you can either make it super simplistic and basic or you can create a complex budget that works the way you need it to work. The nice thing about YNAB is that it makes you work with money you currently have in your bank account. You don't work with money you think you might have a few weeks or months from now. In other words, if you have $500 in your bank account right now, YNAB encourages you to work with that $500 when creating or managing your budget.

Once I started using YNAB, I found out I was spending over $80 on coffee alone each month...so YNAB helps people like myself who like to splurge. The app makes you be more accountable of your own money and it makes you more mindful of your spending. I really like that you can create limits for yourself and the visuals on the app show you your progress month to month. In my brain, YNAB is like the cash envelope system, except you don't need to withdraw cash and it is all done digitally.

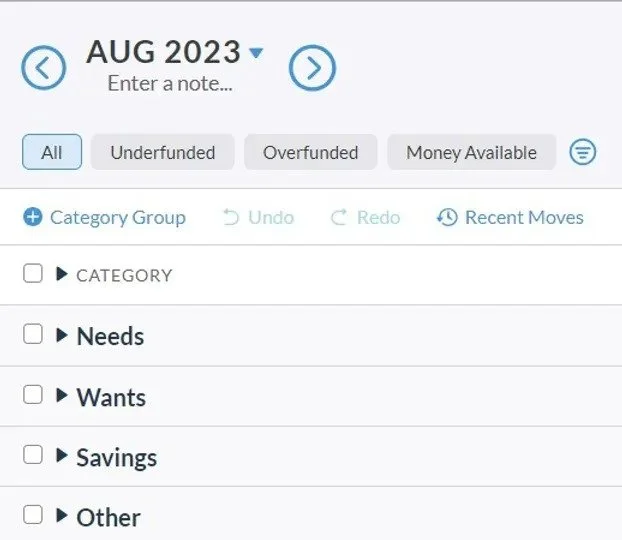

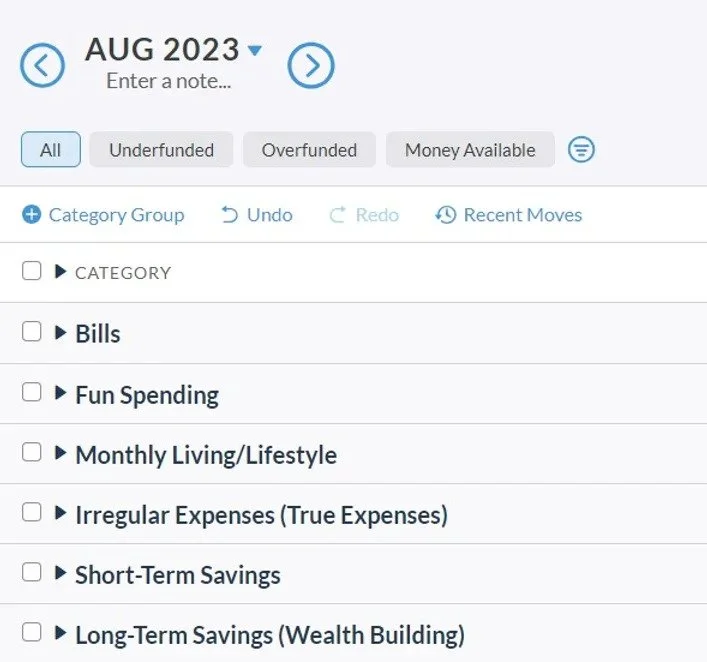

As for assigning expenses, each category group is customizable to whatever your needs are, as mentioned earlier. You can literally have category groups set up as Needs, Wants, Savings, and Other like what you see in Image 1, or you can get all creative and technical with categorization that adjusts to you like what you see in Image 2. I prefer a basic budget so the first image is literally the one I've been using. The second image is a more advanced budget that might make more sense for people with more expenses or have greater experience with money managing. Either way, having a budget whether simple or complex is something everyone should try to incorporate into their life. Having a plan has definitely helped me stress less.

Image 1

Image 2

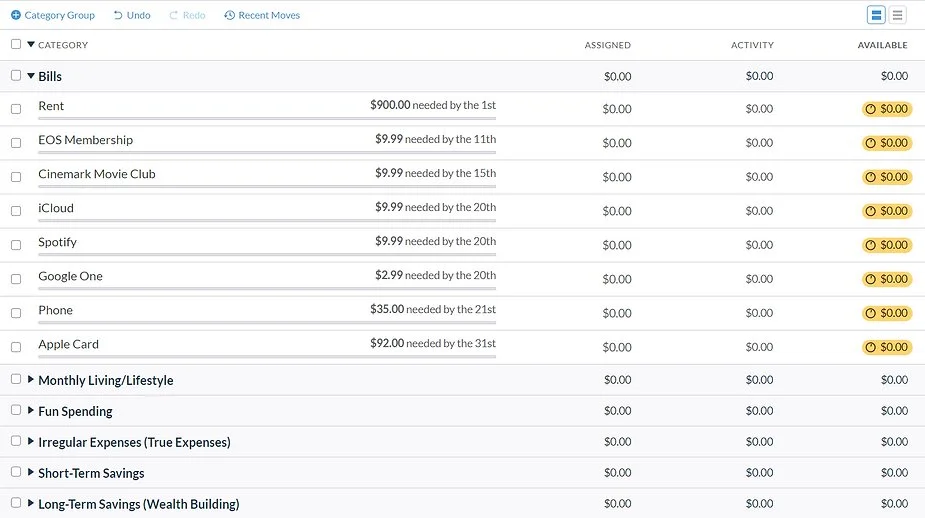

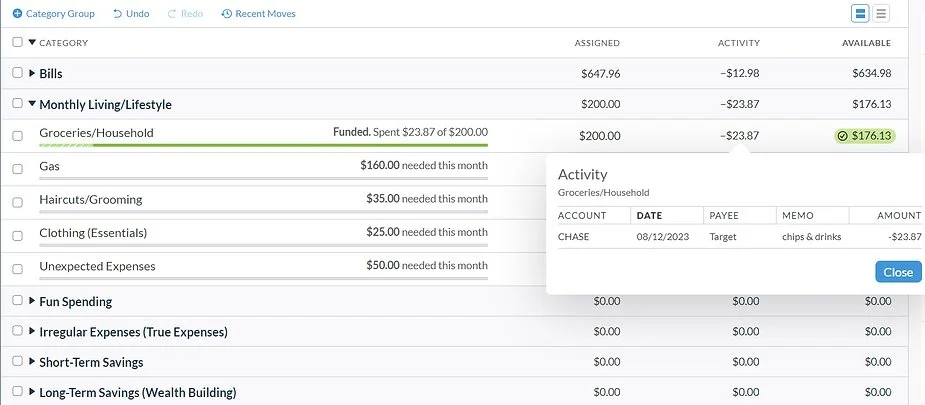

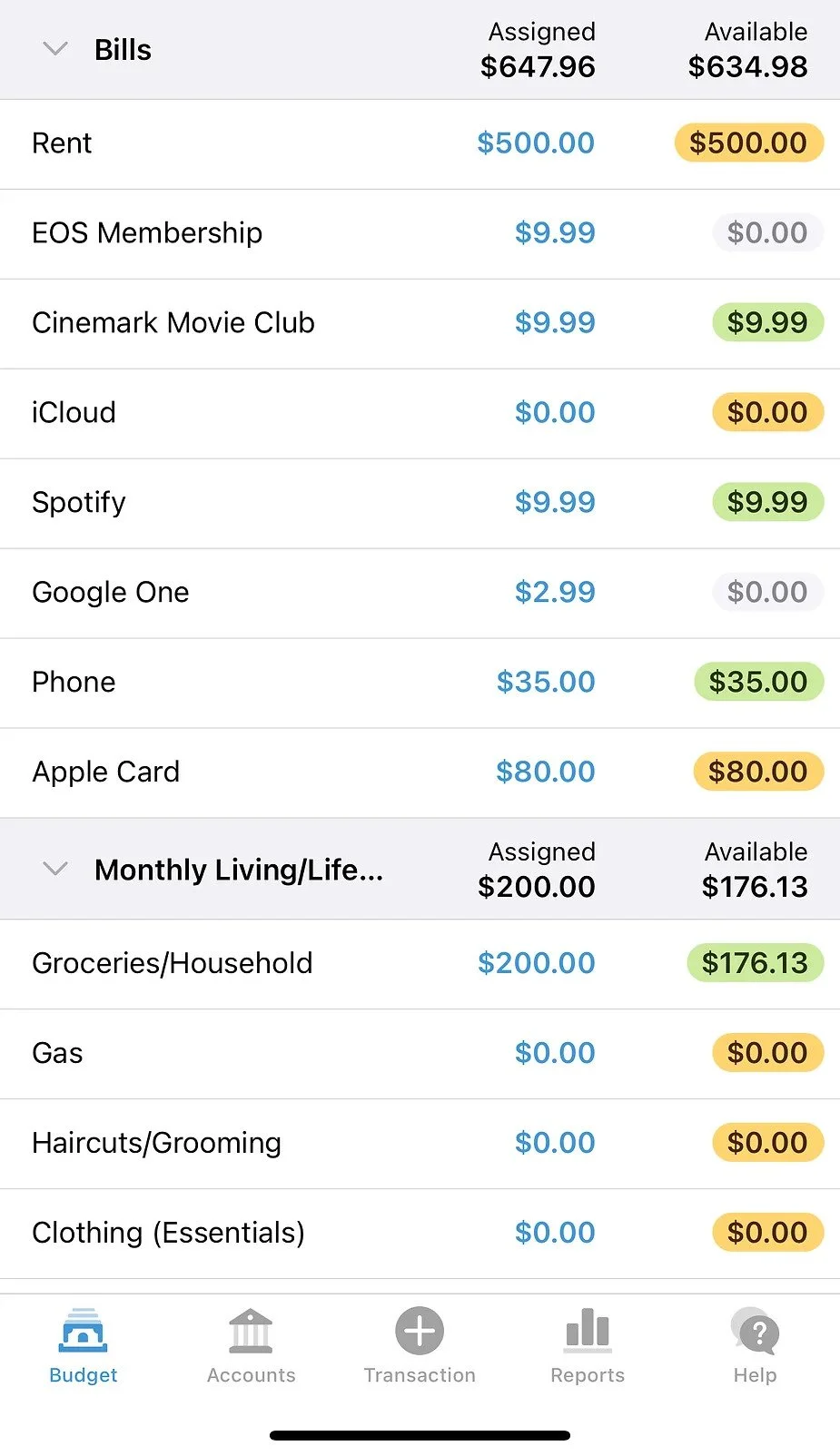

Once your category groups are created, you can then add budget categories in each group. As an example, here is a template of what the Bills category group might look like for someone:

Image 3

YNAB lets you set the dollar amount, due dates if needed, and there's a meter that shows you your progress for each category. I plugged in made-up numbers as examples.

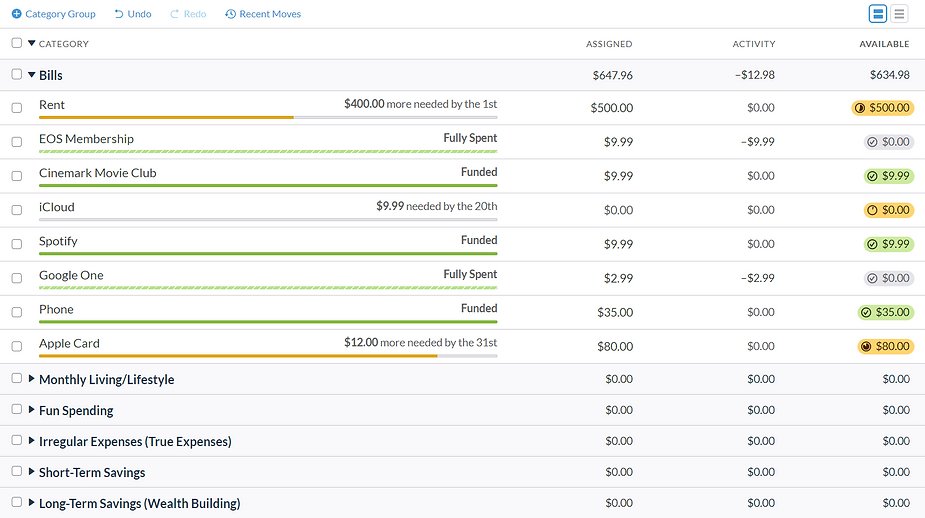

Image 4

When you track your spending, you can also see where your money goes throughout the month and see how much you still have available. This helps you keep yourself accountable and makes sure you're not going over your planned budget limits. You can always adjust these limits depending on your monthly needs or if your expenses ever change.

Image 5

The desktop version gives you a full, detailed view, but the mobile app is just as easy to use and more convenient since we're always using our phones:

Image 6

YNAB has a slight learning curve when starting out, but there are so many resources you can use to guide you through the process of setting up your budget. I didn't go over how to add transactions, how to link your bank accounts, expense reconciliation, target goal settings, how to edit your budget, or the fact that it's a paid subscription ($14.99/month or $98.99/year). I feel like going over those things in detail would be best through a YouTube video. I can only vouch for the software in this post from my personal experience. Here are the videos that helped me learn how to use YNAB:

YNAB For Beginners (2022)

This guy makes it super easy to follow along with him and explains in great detail the why for each step. This video alone helped me get started.

YNAB For Beginners (2018)

Same guy from the 2022 video, but I found this helpful too. It's just more of the same info which helps a lot when getting started.

March 2022 First Paycheck | Student Loan Savings | YNAB Budget With Me

This person also does a great job of explaining the process once your budget is set up. I like that it shows what a real-life budgeting scenario looks like.

You Need A Budget also has great resources on their website. Their customer service is actually good too. As far as the paid subscription part, $15 a month may seem like a lot, but for me personally it's actually not a big deal in the grand scheme of things. The way I see it, the app has helped me save a lot of money so I probably would've spent $15 on something random had I not created a budgeting plan. Plus, they give you a 34-day free trial so you can find out for yourself after a month if YNAB is for you or not. You might qualify for a whole free year if you are a college student.

You Need A Budget should be paying me for all this free advertising I'm giving them. I hope the 1 or 2 people reading this was worth it lol, but either way I just wanted to share this info. The website and the mobile app are fairly easy to use once you practice with it and make it a habit. If you are interested in YNAB, you get a 34-day free trial like I mentioned, but you can also get a free month (I get a free month if you register) by using my referral code: https://ynab.com/referral/?ref=4bjF3oa8FK6TVuB1.

My advice is to learn how to budget sooner rather than later. Money is a very taboo subject (which is silly) so I feel like many of us seek for advice online rather than talk about it in person. Hopefully my ranty review helps someone out. I'm curious to know how others handle their own money. Budgeting is essential, in my opinion, and you might be surprised to find out where your money goes each month. I recognize that for several people, budgeting isn't the issue. A lot of people have an income problem (I can't help with that). But if you have the means to provide with your current income, I encourage you to try budgeting whether it is with YNAB or any other budgeting system you find that works for your lifestyle. And to the finance bros, I'm sorry, but some of us need more grounded advice on money lol.

Now, I am learning more about index funds and how that works through Fidelity. I'll probably make a post about Fidelity in the future if I learn how to use that properly, but I feel like you can't really get into investing and all that stuff if you don't have control of your own money first. Long story short, learn how to budget!!